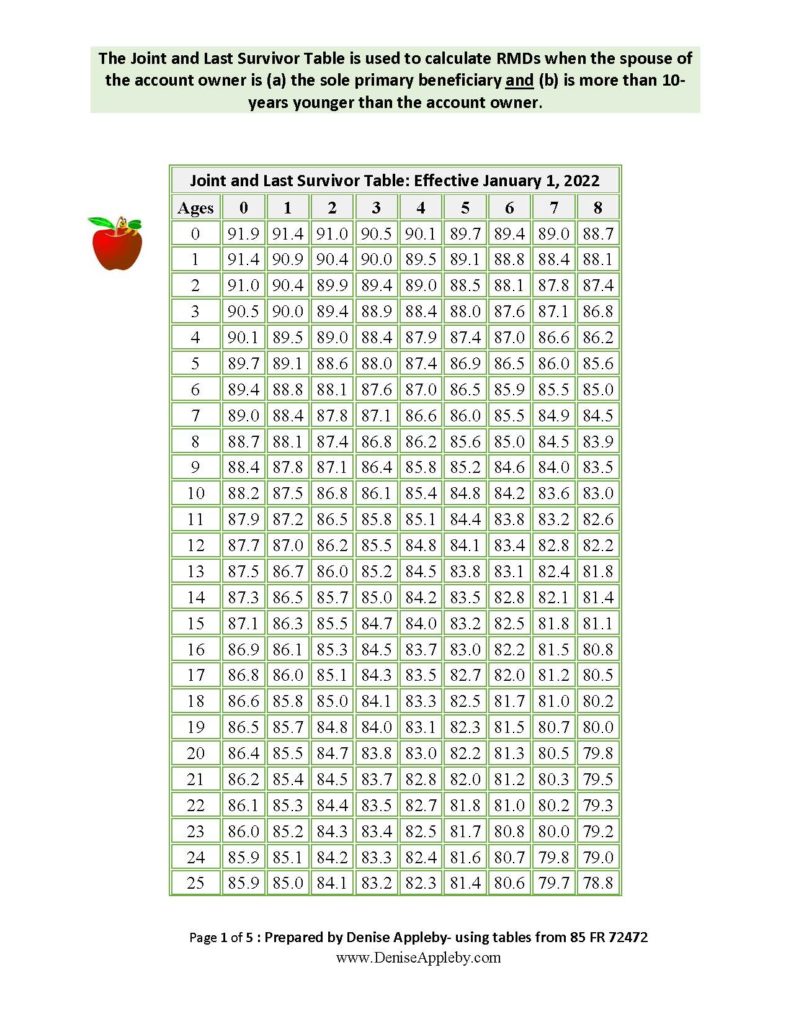

The Joint and Last Survivor Table is used to calculate RMDs when the spouse of the account owner is (a) the sole primary beneficiary and (b) is more than 10‐years younger than the account owner. This is just a sample. Get the full table in Appendix B of IRS Pub 590 B