When establishing a retirement plan for a small business, certain factors must be considered to ensure that the right employer plan is chosen. One such factor is the amount the business owner wants to contribute to the employer plan each year. For a business owner who wants to contribute the maximum amount possible, the choice of employer plan is usually determined by the amount of income (compensation) received from the business for the year. To make the correct determination, calculations should be performed to determine the contribution amounts for the retirement plan.

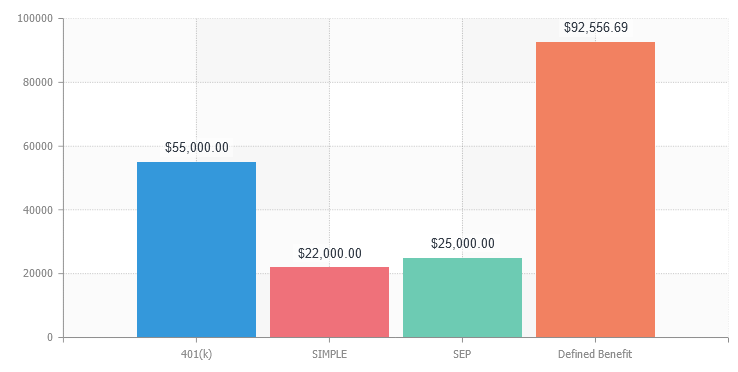

Comparing Contribution limits by Plan Type

The following examples illustrate and compare the limits for corporations vs. sole proprietorships (2023 limits):

| Name | Age | Income | Business Entity |

| Sharon | 55 | $100,000 | Corporation |

| The maximum contribution into an SBOK (self-employed business owner 401(k)) plan is comprised of two elements, the profit-sharing contribution and the 401(k)-salary deferral. The maximum allowable contribution calculation takes the profit-sharing contribution and adds the maximum 401(k) contribution amount. | |||

| Maximum Profit-Sharing Contribution | $25,000.00 | ||

| Maximum 401(k) Contribution | $22,500.00 | ||

| Maximum 401(k) Catchup | $7,500.00 | ||

| Maximum SBOK Calculator Contribution | $55,000.00 | ||

| Maximum SIMPLE IRA Contribution | $18,500.00 | ||

| Maximum SIMPLE IRA Catch-up | $3,500.00 | ||

| Maximum SIMPLE IRA Total Contribution | $22,000.00 | ||

| Maximum SEP Contribution | $25,000.00 | ||

| Maximum Max DB Contribution | $92,556.69 | ||

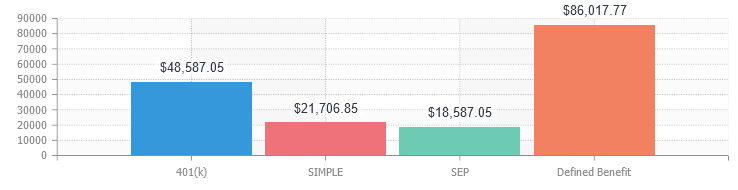

| Name | Age | Income | Business Entity |

| Dante | 55 | $100,000 | Sole proprietorship |

| Earned income is compensation for a self-employed individual covered under a qualified plan. Earned income is calculated by subtracting ordinary and necessary trade or business expenses from your self-employment income. You are self-employed for this purpose if you are a sole proprietor, an independent contractor, a member of a partnership, or are otherwise in business for yourself. | |||

| Net Earnings (before qualified plan deduction) | $100,000.00 | ||

| Calculate 1402(a)(12) Deduction | $92,350.00 | ||

| Calculate Medicare & FICA (TWB of 160200) | $14,129.55 | ||

| 1/2 of Self-Employment Tax | $7,064.78 | ||

| Self-Employment Income | $92,935.23 | ||

| The maximum contribution into an SBOK (self-employed business owner 401(k)) plan is comprised of two elements, the profit-sharing contribution and the 401(k)-salary deferral. The maximum allowable contribution calculation takes the profit-sharing contribution and adds the maximum 401(k) contribution amount. | |||

| Maximum Profit-Sharing Contribution | $18,587.05 | ||

| Maximum 401(k) Contribution | $22,500.00 | ||

| Maximum 401(k) Catchup | $7,500.00 | ||

| Maximum SBOK Calculator Contribution | $48,587.05 | ||

| Maximum SIMPLE IRA Contribution | $18,206.85 | ||

| Maximum SIMPLE IRA Catch-up | $3,500.00 | ||

| Maximum SIMPLE IRA Total Contribution | $21,706.85 | ||

| Maximum SEP Contribution | $18,587.05 | ||

| Maximum Max DB Contribution | $86,017.77 | ||

Calculations done using SBOk Calculator by Flexsoft, inc.

As the examples above demonstrate, an SBOK allows for the highest contribution amounts for the compensation received. However, for a business owner that prefers to adopt another type of plan instead of a 401(k) plan, SIMPLE IRAs may allow for higher contribution amounts than the other plans for lower compensation. For example, W-2 wages of $50,000 would allow for the following contribution amounts. Calculations should be done to determine the limits for each type of plan.

Multiple Plans May Mean Opportunities to Increase Contributions

Small business owners who participate in multiple plans may be able to increase their annual contribution amounts by making the maximum allowable contribution amount to each plan. However, this can only be done if the employer plans are maintained by unrelated and unaffiliated employers, i.e., employers which are not part of a controlled group or affiliated service group.

Caution: Due to the complex nature of the rules that govern affiliated and related employers, clients should consult with an ERISA attorney to determine whether multiple businesses with common ownership or affiliation are related/affiliated. Any violation of the rules can lead to the disqualification of plan assets.

The following is an example where the employers are not related or affiliated, and the business owner is, therefore, eligible to contribute the maximum amount to each plan.

Example: John works for ABC Corporation and participates in their 401(k) plan. His relationship with ABC is limited to that of an employee. John operates a consulting business on the side and operates a Solo-k for his consulting practice.

John may contribute the maximum allowable amount to both plans.

Caution: The salary deferral limit applies. Therefore, John’s aggregate salary deferral contribution to both plans cannot exceed $22,500 for 2023, plus catch-up of $7,500.

The “Smell Test”– Determining if ERISA Expertise is Needed

Employers that are related or affiliated are treated as one employer for purposes of determining the allowable contribution amounts to employer-sponsored retirement plans (the annual addition limit). Except in cases where no such relationship exists, determining if an affiliated or related situation exists can be challenging. In addition, narrowly defined exceptions apply that could result in a seemingly related/affiliated employer not being treated as such for plan purposes. If there is any doubt about whether an employer is affiliated/related, an ERISA attorney should be consulted.

Some Other Factors that affect the choice of plan

In addition to the amounts that can be contributed to the type of retirement plan, other factors may influence a business owner’s choice of retirement plan. These include the following:

- Funding flexibility. A newly established business may prefer a SEP IRA or a profit-sharing plan because of the discretionary contribution feature. This allows the business owner to determine from year-to-year whether contributions will be made to the employer plan.

- Vesting permissibility: A business with common-law employees may want participants to ‘earn’ the contributions made to their accounts. This can be accomplished by choosing a vesting schedule- for instance, the vesting schedule could require that an employee participates in the plan for five years to become entitled to or ‘own’ contributions made by the employer. In addition, a vesting schedule may be ideal for a business with a high staff turnover.

- Cost of maintenance: IRA-based plans, such as SEP IRAs and SIMPLE IRAs, are typically low-cost maintenance plans, as they do not require the services of a third-party administrator, and no Form 5500 filings are required. Qualified plans may require nondiscrimination and top-heavy testing, which usually requires the services of an employer plan professional, and form 5500 filing is required except for certain owner-only plans with balances of $250,000 and under. These services can be costly.

Common mistakes made with establishing and maintaining employer plans

Businesses usually adopt retirement plans with the best of intentions. However, errors sometimes happen, resulting in loss of qualified status, or missed opportunities for the business owner and participants. The following are a few of the common mistakes:

- Small business owners with ‘Corporations.’ Small business owners who incorporate their business may forget to pay themselves W-2 wages. These W-2 wages are usually the only form of income from the company that the business owner can use to determine retirement plan contributions.

- Excluding eligible employees: Some business owners really want to cover only themselves under their retirement plan. However, the governing laws include provisions that ensure that common-law employees are covered, provided they are eligible. Failure to include eligible employees can result in disqualification of the plan.

- Maintaining another plan along with SIMPLE IRA or SIMPLE 401(k) Plan when the defined exceptions do not apply

- Failing to perform required updates/amendments to plans according to the new tax laws.

Changing Choice of Plan

There is no ‘wrong’ retirement plan type for a business owner. However, should it be determined later that the initial plan chosen was not the ideal plan type, there are ‘corrective’ measures that can be implemented. One such measure would involve terminating the current employer plan and rolling over or transferring the balance to the new employer plan.

Certain restrictions apply- for instance, after-tax amounts and amounts representing required minimum distributions cannot be rolled over from an IRA to a qualified plan, and SIMPLE IRA assets cannot be rolled to another plan type until at least two years have elapsed since the first deposit was made to the SIMPLE account.

For qualified plans that are terminated, the assets should generally be distributed within one year of the termination date. These amounts can be transferred or rolled over to another qualified plan or a SEP IRA or Traditional IRA.

Action Plan

For any Business Owner considering adopting a retirement plan for their business, it is strongly recommended that an analysis be conducted to determine the features and benefits most important to them. This will help to ensure that the correct type of retirement plan is adopted. Additionally, the business owner should work with their tax professional and retirement counselor to determine whether additional expertise is required to help ensure that the employer plan operates under regulatory requirements.

Disclaimer: Employers must consult with their tax advisors and plan administrators to determine their actual contributions and deductible limits. This article cannot be used as tax, financial, or legal advice under any circumstance. The user agrees to these terms by using this article.