Denise Appleby explains why 2021 Is The Last Opportunity To Override 5-Year Rule and Stretch Distributions for 401(k)s Inherited in 2019. Designated beneficiaries who inherit retirement accounts in 2019 get a one-year extension to override the 5-year rule. The deadline is extended from December 31, 2020, to December 31, 2021.

Suppose you inherited assets held in an employer plan in 2019 and find that you are required to fully distribute the account within 5 years. In that case, you might be able to override that limitation and stretch distributions over your life expectancy. To do so, you must take action by December 31, 2021. For this purpose, employer plans include qualified plans such as 401(k) and pension plans, 403(b) plans, and Governmental 457(b) plans.

Background

If you inherited assets before 2020 which are held in an employer plan, and the owner died before the required beginning date (RBD), you generally have two options for distributing your inherited account. The 5-year rule and the life-expectancy rule. The plan document terms determine whether both or one of the two options are available to you.

The following are some key terms that are relevant to this article:

- Plan document: The set of rules that dictate the terms of the employer plan under which you inherited the retirement account or benefit (account).

- The RBD: The RBD is April 1 of the year that follows the year in which the account owner (participant) reached age 70-½. If permitted under the plan document, the RBD can be deferred past that date until April 1 of the year that follows the year in which the participant separates from service with the plan sponsor (employer).

- The 5-year rule: Under the 5-year rule, you choose whether to take any distributions in years one through four. But, the entire account balance must be distributed by the end of year five. This is extended to six years for accounts inherited in 2015 to 2019 because a recent law – The Coronavirus Aid, Relief, and Economic Security (CARES) Act, provides that 2020 is not counted when counting the 5-year period.

- The life-expectancy rule: Under the life expectancy rule, you would take distributions over your life expectancy every year beginning by December 31 of the year that follows the year the participant died. Your life expectancy would be determined based on a Single Life Expectancy Table published by the IRS. As above, the CARES Act waived these distributions for 2020.

- Designated beneficiary: Only a designated beneficiary is eligible to use the life expectancy rule when the participant died before the RBD. Generally, a designated beneficiary is a person who inherits a retirement account. A trust can also be a designated beneficiary if certain specific requirements are met.

Whether you are a designated beneficiary for an account you inherited in 2019 would have been determined as of September 30, 2020. Consult with your tax advisor or attorney if you are unsure about whether you are a designated beneficiary.

Limited scope: The rules that apply if the participant died on or after the RBD are different and are not discussed in this article as they are irrelevant to the strategy being discussed. Additionally, the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 changed the distribution options for accounts inherited after 2019, and these are also not covered herein.

The Tax Impact of the 5-Year Rule vs. The Life Expectancy Rule

If you are a designated beneficiary who inherited a significant amount under a retirement account, being able to take distributions over your life expectancy might be more tax-favorable than having to fully distribute the account within 5 years. This is because the life expectancy distributions would generally require smaller amounts to be included in income each year.

Consider the following example:

401(k) participant profile

- Date of birth: 01/01/1958

- Date of death: 01/01/2019

Designated Beneficiary profile

- Date of birth: 01/01/1970

- Date of death: N/A

The assumed rate of return: 5%

The total distribution amounts under each option would be:

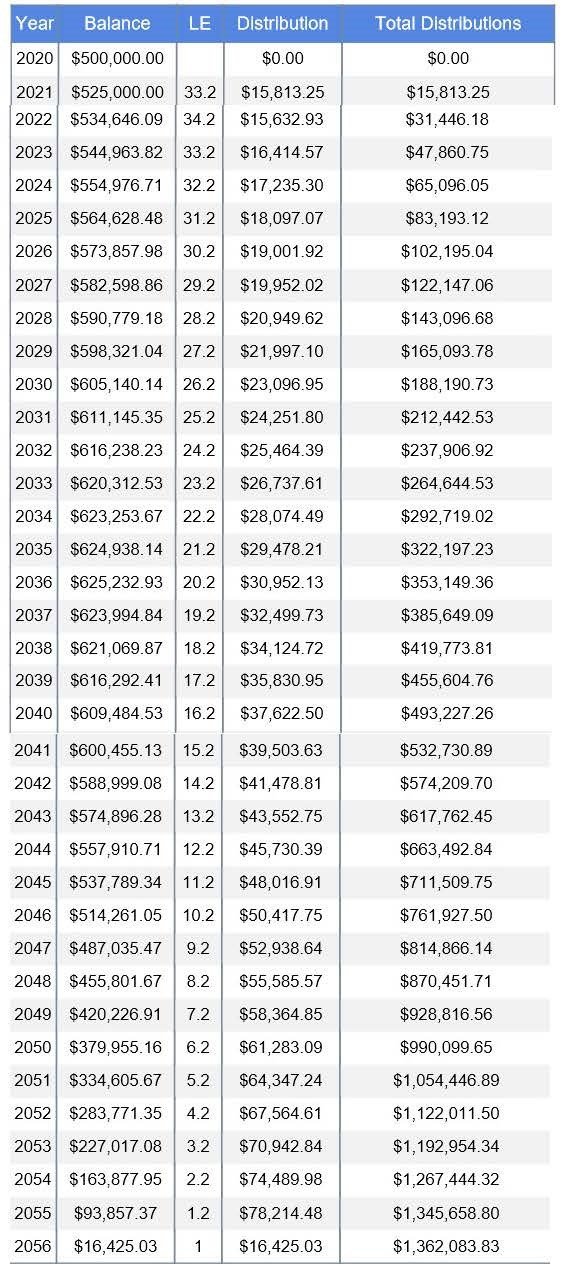

Life expectancy distributions: Assuming distributions are taken under the life expectancy option and that no more than RMDs are taken each year, the total distributions would be about: $1,362,000. The amount distributed each year would range from about $15,000 to $78,000. These smaller amounts could help keep the beneficiary in a lower tax bracket than taking larger amounts within five years, thus reducing the tax impact.

Additionally, amounts that remain after RMDs would continue to grow on a tax-deferred basis. Finally, all distributions would be tax-free if the account is a Roth.

The following is the annual RMD amounts, using the profile above:

5-year rule: Assuming no distributions are taken until the end of the 5-year period, the total distributions would be about $638,000.

Overriding the 5-Year Rule

If you inherited a qualified plan account in 2019, the terms of the plan might default to the 5-year rule. In such cases, you are generally required to take action by December 31, 2020, to be eligible to take distributions over your life expectancy. However, the deadline was postponed to December 31, 2021. The following are the two scenarios that could apply.

1: The Plan Document Permits You To Choose

The terms of a plan document may permit the participant or a designated beneficiary to choose between the 5-year rule or the life expectancy rule. This election is generally required to be made by December 31 of the year that follows the year the participant died.

Example: John, a 401(k) participant whose date of birth is January 1, 1958, died in 2019. His beneficiary is his sister Lupita.

Under the terms of the 401(k)-plan document. Lupita must elect the 5-year rule or the life expectancy rule by December 31, 2020.

Postponed Deadline: The SECURE Act allows the plan to be amended to allow Lupita – and other beneficiaries in the same category, to make the election by December 31, 2021.

2: The Only Option Is The 5-year Rule

The terms of a plan document may provide that the 5-year rule is the only option available when the participant died before the RBD. If your inherited account is subject to this limitation, you can override it and use the life expectancy option by rolling over the balance to a beneficiary IRA that allows life expectancy distributions. Such a rollover must be done as a direct rollover (paid directly to the beneficiary IRA) by December 31 of the year that follows the year the participant died.

Example: Jackie, a 401(k) participant whose date of birth is January 1, 1959, died in 2019. Her beneficiary is her brother, Ray.

Under the terms of the 401(k)-plan document, Ray is subject to the 5-year rule. Ray may override the 5-year rule by moving the amount via a direct rollover to a beneficiary IRA that allows life expectancy distributions by December 31, 2021 (extended from December 31, 2021 under the SECURE Act).

Act Now!

If you inherited a retirement account in 2019 from a participant who died before the RBD and you want to use the 5-year rule, you may do so by distributing the entire balance by December 31, 2025. But if you want to use the life expectancy rule and it is not the default option under the plan, you must check with your plan administrator to ensure any required action is taken by December 31, 2021.