The IRS issued Notice 2022-55 in which they provide retirement plan limits for 2023. Many the limits were changed from those that were in effect for 2023. The following are the highlights.

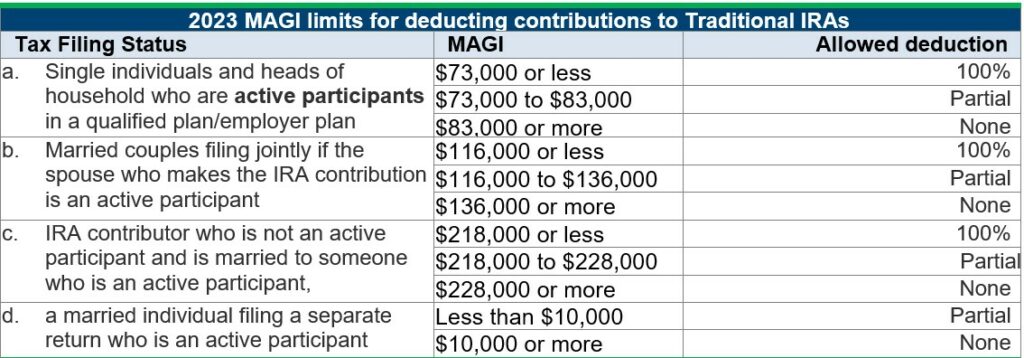

2023 Traditional IRA MAGI Limit for Deductibility

Individuals who are active participants are eligible to deduct their Traditional IRA contributions, only if their modified adjusted gross income (MAGI) amounts do not exceed certain limits. For details on how this works, see the article Active Participant Status–Can You Deduct Your IRA Contribution?

The MAGI limits that apply to each tax-filing status are as follows:

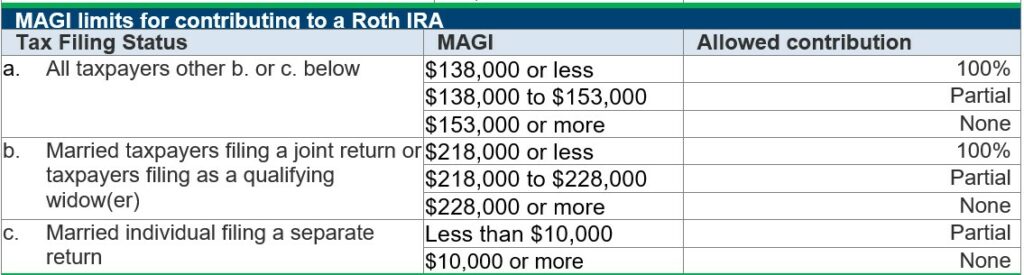

2023 Roth IRA MAGI Limits for Contributions Eligibility

Individuals may contribute to a Roth IRA only if their MAGIs do not exceed a certain amount. The limits are as follows:

For more on Roth and Traditional IRAs, see the article Traditional or Roth IRA Contribution- Making The Choice.

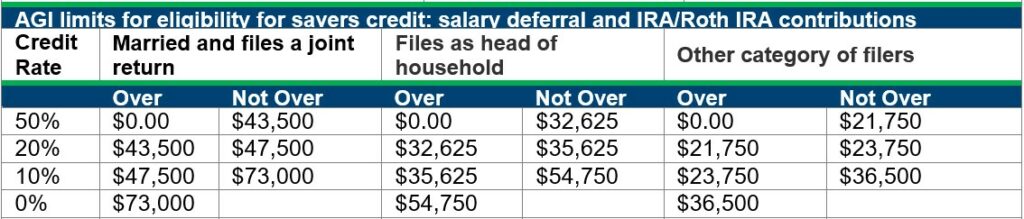

2023 AGI Limit for Savers Credit

A nonrefundable savers tax credit is available to eligible individuals who make contributions to their Traditional IRAs and/or Roth IRAs, as well as to those who make salary deferral contributions to an employer sponsored retirement plan. This saver’s credit is capped at $1,000, and the percentage for which the individual is eligible depends on his/her adjusted gross income (AGI). For an explanation of the saver’s credit and how it works, see The Saver’s Credit- an Often Overlooked Retirement Savings Benefit:

The following are the AGI limits and the credit rate percentage for which individuals are eligible.

The following IRA and employer plan limits for 2023 were also announced.

- IRA Contribution limit for Traditional and Roth IRA : $6,500: The maximum amount that an individual can contribute to an IRA for the year is 100% of eligible compensation or $6,500, whichever is less. This can be contributed to either a Traditional IRA or a Roth IRA, or split between both. The aggregate amount cannot exceed $6,500.

- Catch-up contribution limit for Traditional and Roth IRAs : $1,000: Individuals who are at least age 50 by the end of the year can make an additional IRA contribution of $1,000. This is referred to as a catch-up contribution. The $1,000 can be a contribution to a Traditional IRA or Roth IRA, or split between both. The aggregate amount cannot exceed $1,000.

- Salary deferral contributions to plans such as 401(k), federal thrift savings (TSP), or 403(b) plan: $22,500: Maximum amount of salary deferral contributions that can be made by an individual for the year. This is a ‘per individual’ limit. Therefore, regardless of the number of 401(k), thrift savings plan, SIMPLE IRA, SIMPLE 401(k) or 403(b) plans in which the individual participates, the aggregate salary deferral contributions for the year cannot exceed $22,500 + catch-up contributions

- Salary deferral contributions to 457(b) plans: $22,500: Maximum amount of salary deferral contribution that can be made to a 457(b) plan. If someone participates in a 457(b) plan and also participates in a 403(b) plan [for example], he/she could make salary deferral contributions of up to $22,500 to each + catch-up.

- SIMPLE IRA Salary deferral: $15,500: Maximum amount of salary deferral contributions that can be made to a SIMPLE IRA for the year

- SIMPLE 401(k) Salary deferral : $15,500: Maximum amount of salary deferral contributions that can be made to a SIMPLE 401(k) for the year

- Catch-up contribution to 401(k) and 403(b) plans: $7,500: Maximum amount of catch-up contributions that can be made for the year. This does not include catch-up contributions made to 457(b) plans

- Catch-up contribution to 457(b) plans: $7,500: Maximum amount of catch-up contributions that can be made to a 457(b) plan.

- Catch-up contribution limit for SIMPLE IRAs : $3,500: Maximum amount of catch-up contributions that can be made to a SIMPLE IRA for the year

- Catch-up contribution limit for SIMPLE 401(k) plans: $3,500: Maximum amount of catch-up contributions that can be made to a SIMPLE 401(k) for the year

- Annual addition dollar limit for defined contribution plans/SEP IRAs: $66,000: Maximum dollar amount that can be added to a participant’s account for the year. This applies on a per-employer basis. Therefore, if an individual works for two separate employers, that individual could receive $66,000 to each plan + catch-up. For this to be possible, the employers must not be part of a controlled group or affiliated service group.

- Annual benefit dollar limit for defined benefit plans : $265,000: Maximum benefit payable annually in the form of a straight life annuity under a defined benefit plan

- Compensation cap: $330,000: The maximum amount of compensation that can be taken into account when computing plan contributions and benefits. For SIMPLE IRAs, this cap applies only to non-elective contributions.

- Minimum SEP compensation : $750: Employees who earn at least $750 must share in SEP contributions for the year, providing they meet the other eligibility requirements

- Dollar limitation for defining a key employee: $215,000: A plan is considered to be top-heavy if more than 60% of assets under the plan are owned by key-employees

- Dollar limitation for defining highly compensated employee (HCE) : $150,000: Nondiscrimination testing is required to be performed for qualified plans to ensure benefits are not discriminately skewed in favor of highly compensated employees

- Maximum account balance in an ESOP under Section 409(o)(1)(C)(ii): $1,330,000: The dollar amount for determining the maximum account balance in an ESOP subject to a 5‑year distribution period

- Maximum dollar amount in an ESOP under Section 409(o)(1)(C)(ii) : $265,000: The dollar amount under Section 409(o)(1)(C)(ii) used to determine the lengthening of the 5 ‑year distribution in an ESOP

- Annual compensation limit under Section 401(a)(17) for eligible participants in certain governmental plans: $490,000: The annual compensation limitation for eligible participants in certain grandfathered governmental plans remains unchanged

For Social Security Changes, click here .