By Denise Appleby, APA,QKA,CISP,CRC,CRPS,CRSP

Details and examples of the SECURE Act 2.0 RMD age change equip you to guide clients promptly. Missing RMD deadlines, miscalculating RMD amounts, and taking less than the RMD amounts are common mistakes. Don’t let clients get caught in the shuffle.

SECURE Act 2.0 increased the starting age for RMDs, providing up to three extra years before some IRA owners need to begin. However, those who have already started RMDs before 2023 must continue. Missing an RMD deadline means owing an excise tax to the IRS.

In 2019, Congress told Americans that they must start their required minimum distributions (RMDs) from their tax-deferred retirement accounts when they attain age 72 (up from age 70½ for those who attained age 70½ after 2019). But new rules provide a later starting age for those who attain age 72 after 2022.

Because of these new rules, those born in 1951 or later have no RMDs for 2022. Instead, RMDs for those individuals must begin when they attain age 73 or 75, depending on the year they were born. For those who miss their RMD deadlines, the new law reduces the excise tax from 50% to as low as 10%.

Reminder: RMDs do not apply to Roth IRA owners!

Action plan for advisors

A. Contact IRA owners who will attain age 72 in 2023. Tell them there is no RMD for this year, but they can still take distributions if they want to. A sample letter is available herein our IRA Basket of Goodies (paid subscription required for access).

B. Send a letter to IRA owners about the RMD changes.

C. For advisors who work with qualified retirement plans for small business owners, please include them in the process. They might not have third-party administrators to help them with RMD administration.

D. Perform an assessment to determine if it would be tax efficient for a participant to take distributions when there are no RMD requirements, instead of waiting until RMDs are due.

E. Work with those who miss their RMD deadlines to either request a waiver or pay the excise tax.

Background on changes to RMD starting age

The Setting Every Community Up for Retirement Act (SECURE Act) of 2019 increased the age for starting RMDs from 70½ to 72 for owners of IRAs, participants in defined contribution plans, and participants in 403(b)s and governmental 457(b) plans (participants). This increase applies to those who reached age 70½ after 2019.

The SECURE Act 2.0, signed into law on December 29, 2022, increases the RMD starting age even further. Now, the starting ages for RMDs are as follows

- A participant born in 1950 or earlier already should have started taking RMDs and must continue for every year going forward.

- Reminder: If the participant attained age 72 in 2022, they have until April 1, 2023 to take their 2022 RMD. All other RMDs must be distributed by the end of the year to which they apply.

- A participant born from 1951–1959 must start taking RMDs in the year they reach age 73. And,

- A participant born in 1959 and after must start taking RMDs when they reach age 75.

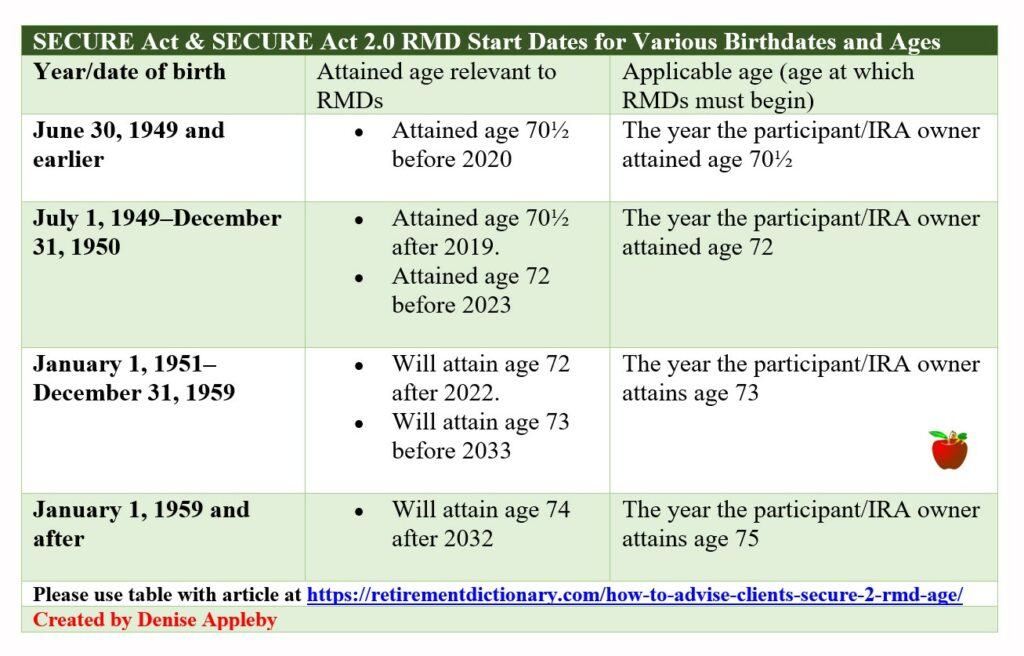

The following table provides a snapshot of when RMDs begin. Note: There is an overlap for someone born in 1959, as they fall into the age 73 and 75 groups. I expect the IRS to provide clarification and will keep you posted.

A participant with assets in an employer plan (defined contribution plan, 403(b) plan, and governmental 457(b) plan) and who is still employed by the plan sponsor is allowed to defer RMDs past these ages if such deferral is permitted under the plan. However, the option to defer RMDs past these ages is not available to an employee who is a 5% owner.

Participants should check with their human resources department regarding the rules for their employer plan.

RBD remains April 1 of the year after the first RMD year

A participant may take their first RMD as late as April 1 of the year following the year they attain the applicable RMD age—this date is their required beginning date (RBD). However, all other RMDs must be distributed by the end of the year to which they apply. Therefore, a participant who chooses to defer their first RMD until the following year will need to take two RMDs for that year. The tax impact of deferring an RMD until the following year should be considered before deciding whether to defer.

The following examples explain further.

Example 1

- Jane was born in 1950

- Jane attained age 72 in 2022

- Jane’s first RMD is due for 2022

Jane must take her 2022 RMD on any date from January 1, 2022, to April 1, 2023. But if Jane takes her 2022 RMD in 2023, she must take two RMDs in 2023 because her 2023 RMD must be taken by December 31, 2023.

Example 2

- Tom was born in 1951

- Tom falls into the age 73 group for starting RMDs

- Tom’s first RMD is due for 2024, when he will attain age 73

Tom must take his 2024 RMD on any date from January 1, 2024, to April 1, 2025. All his other RMDs must be taken by the end of the year to which they apply.

Example 3

- Dani was born in 1960

- Dani falls into the age 75 group for starting RMDs

- Dani’s first RMD is due for 2035 when she will attain age 75

Dani must take her 2035 RMD on any date from January 1, 2035–April 1, 2036. All her other RMDs must be taken by the end of the year to which they apply.

Be aware: Some custodians still sending (inapplicable) 2023 RMD notices. IRA custodians must send RMD notices to IRA owners who are required to take RMDs for the year. These notices must be sent by January 31 of the year to which the RMD applies. It appears that some IRA custodians were not able to stop those notices from going out to IRA owners who will attain age 72 in 2023. Taxpayers who attain age 72 in 2023 should disregard any such notices, because their RMDs will not begin until 2023, when they reach age 73.

Planning opportunity

The RMD amount for a participant is determined by their age, whether they are required to use the Uniform Lifetime Table or the Joint Life Expectancy Table, and the fair market value of the account for the end of the year that precedes the RMD year. For an account with a balance of $1 million held by a participant who will attain age 72 in 2023, this means not having to take (what would have been an RMD of) about $36,000 for 2023. For a participant born in 1960, the (now non-RMD) amounts would be much more.

Case studies

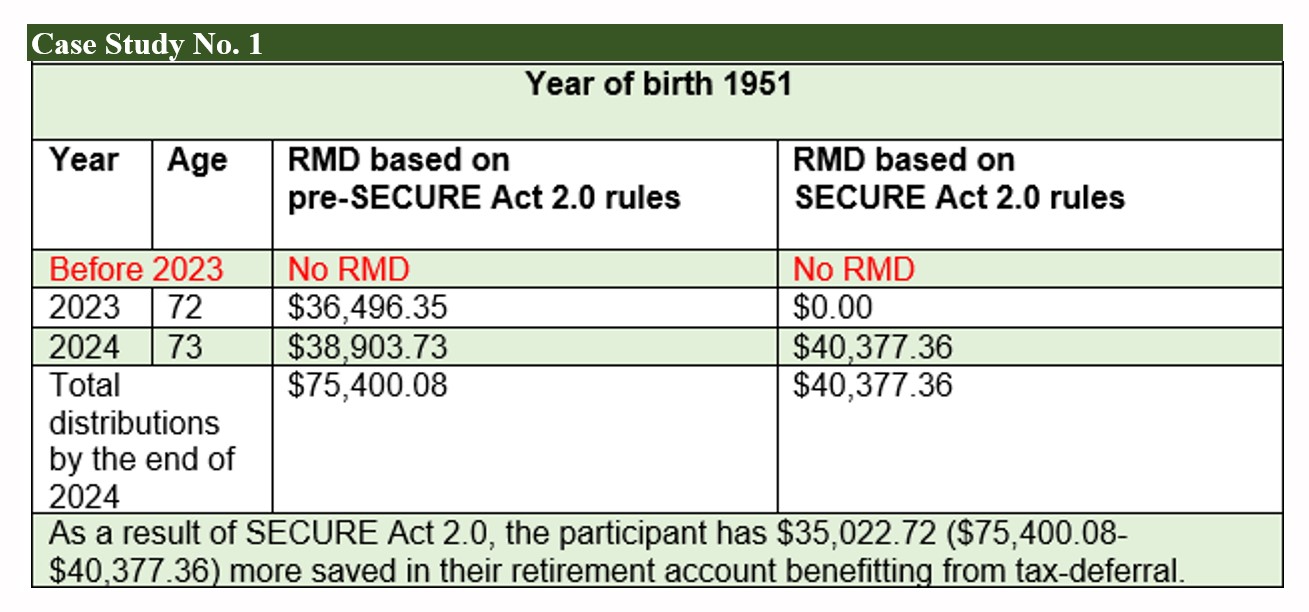

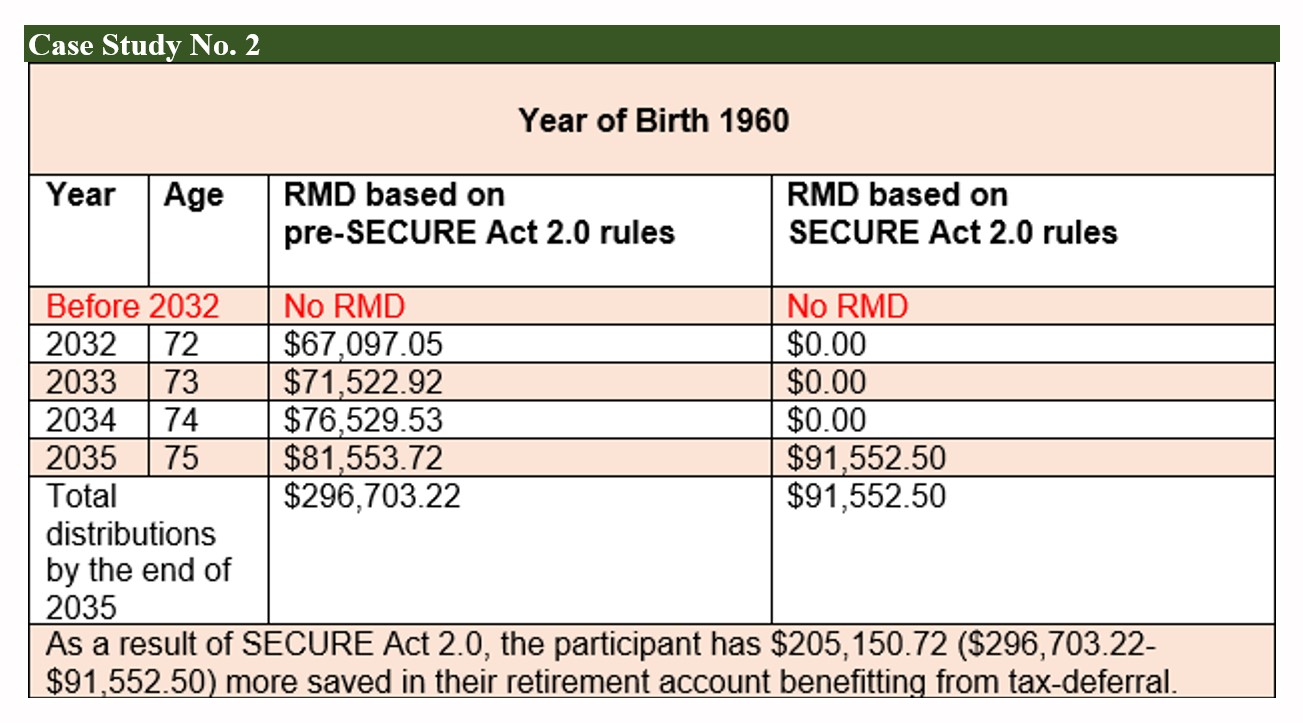

Assuming an account balance of $1 Million, a rate of return of 7%, and no activity other than RMDs, the RMDs would be:

Case Study No. 1

Case Study No. 2

A participant who finds that they no longer have RMDs for applicable years because of SECURE Act 2.0 can still take distributions if they want to. Because those amounts are not RMDs, they can be converted to Roth IRAs. If tax planning already shows that it makes good tax sense to take distributions of those amounts, it presents an excellent opportunity to convert those amounts to Roth IRAs. Distributions from Roth IRAs would be completely tax-free once the participant, having already met the age 59½ requirement, has funded any Roth IRA for at least five years.

Reduction in excise tax on RMD failures

A participant who misses the deadline for taking an RMD will owe the IRS an excise tax on the shortfall. SECURE Act 2.0 reduces the excise tax rate from 50% of the RMD shortfall to 25%. The penalty is further reduced to 10% if the following requirements are met:

- The RMD shortfall is distributed during the (new) correction window (defined below),

- The shortfall is distributed from the same account that had the shortfall, and

- The participant submits a return, during the correction window, reflecting the excise tax of 10%

Currently, the return used to report the excise tax on RMD failures (excess accumulation) is IRS Form 5329, Additional Taxes on Qualified Plans (including IRAs) and Other Tax-Favored Accounts (Form 5329). Form 5329 should be updated to reflect these changes in time for 2023 tax returns to be filed.

Important: This provision requires that the shortfall is remedied from the account to which it applies. Arguably, this means that an RMD shortfall for a traditional IRA, SEP IRA or SIMPLE IRA that a participant owns can be taken from any of those IRAs because IRAs are aggregated for RMD purposes. The same is true for a participant with multiple 403(b) accounts.

On the other hand, RMDs for defined contribution plans cannot be aggregated. Therefore, an RMD for a defined contribution plan must be satisfied independent of another employer’s defined contribution plan.

Inherited IRAs of the same type (Roth with Roth, and non-Roth with non-Roth) can be aggregated if they were inherited from the same decedent.

The new correction window

The correction window begins on the date on which the excise tax is imposed and ends on the earliest of:

- the date the IRS mails a notice of deficiency regarding the excise tax

- the date on which the excise tax is assessed, or

- the last day of the second taxable year that begins after the end of the taxable year in which the excise tax is imposed.

This provision is effective 2023.

Taxpayers can still request a waiver of excise tax

The option to request a waiver of the excise tax on an RMD shortfall was not repealed by SECURE Act 2.0 and is, therefore, still available. Under this waiver provision, the IRS will waive the excise tax if the RMD deadline was missed due to reasonable error and steps are being taken to remedy the shortfall. A tax advisor who determines that a taxpayer qualifies for a waiver should file IRS Form 5329 and complete the section on “Additional Tax on Excess Accumulation in Qualified Retirement Plans (Including IRAs).”

Based on the current instructions for Form 5329, the excise tax should not be paid if a waiver is requested. If the request is not granted, the IRS will notify the taxpayer of how much is owed and the payment should then be made, unless the IRS’s assessment is appealed. Should the IRS deny the waiver request, the excise tax that would be owed depends on whether the shortfall occurred for the 2023 tax year or earlier. And where the shortfall occurred in 2023 or after, the excise tax that would be owed depends on whether the shortfall was corrected during the correction window.

Impact on inherited accounts

One of the key factors for determining the distribution options available to an inherited retirement account is whether the owner died before the RBD. Therefore, advisors should keep a calendar schedule of the different RBDs, to help clients determine if the participant died before the RBD.

Beneficiaries who miss RMD deadlines for their inherited accounts are covered under the new (reduced) excise tax rates for RMD failures.

Share updates with participants

Missing RMD deadlines, miscalculating RMD amounts, and taking less than the RMD amounts are common RMD mistakes. These new rules will compound those errors if participants do not receive helpful guidance from their advisors.

Advisors should inform their clients about these changes promptly. This information is crucial for those who attain age 72 in 2023, as some IRA custodians did not have enough time to switch off their 2023 RMD notices.