Written by Denise Appleby: For Financial Advisors

The Small Business Owner 401(k) is an ideal retirement plan for many self-employed individuals. A retirement savings solution with contribution flexibility is only one of the attractive features.

Appleby’s Top 10 Reasons Why a Small Business Owner 401(k) Is A Great Retirement Savings Solution

If you are looking for an effective asset-gathering tool that provides self-employed clients with a retirement savings solution, the Small Business Owner 401(k) (SBOK) might be ideal. SBOKs are 401(k) plans designed for small businesses for which the only employees eligible to participate in the plan are the business owners. The SBOK allows a participating business owner to contribute up to $58,000 ($61,000 for 2022) for the year and accept rollovers from other eligible retirement plans. This target market is over 27.1 million- counting only nonfarm sole proprietorship and is likely more if we include corporations.

A small business owner may choose other types of retirement plans, and there are varying reasons why one might be more suitable than the other. For those eligible to set up an SBOK plan, the following are my Top 10 reasons it could be the ideal solution to helping them fund their retirement nest egg.

1: An SBO is 401(k) Minus the Complicated and Costly Testing

As the saying goes, there is nothing new under the sun. This rings true for the SBOK as it is merely a 401(k) plan.

Small business owners find 401(k) plans attractive for many reasons, including the multiple types of contributions allowed and the option to offer loans to participants. However, many avoid it because of the administrative complexities and costs. Those who are eligible avoid these deterrents by choosing SBOKs.

Because an SBOK covers only the owner(s) of the business, it is not subject to the costly and complex nondiscrimination testing, which typically applies to a 401(k) plan that covers common-law employees.

Financial institutions offer SBOKs as separate products from 401(k) plans that cover common-law employees by packaging them in kits with labels such as Individual-K, Solo-K, and Uni-K. The IRS calls them ‘One Participant’ plans.

2: It’s for Sole Proprietors, Partnerships, Corporations

You may cast your marketing net wide to include various business structures- sole proprietorships, corporations, and partnerships- for SBOK plans. A business can adopt an SBOK as long as the business owners are the only ones eligible to participate in the plan. For this purpose, business owners include the spouses of the owners.

Businesses with Ineligible Common-law Employees Qualify

For a business that hires common-law employees, the eligibility requirements for the plan determine whether those employees would be eligible and thus disqualify the business from adopting an SBOK plan. Age and service requirements are selected when the plan trustee completes the 401(k)-adoption agreement.

For the age requirement, employees who are under the age of 21 can be excluded.

For the service requirement, employees who perform less than one year of service can be excluded. For this purpose, an employee accrues a year of service after working 1000 hours during the plan year.

These requirements may be reduced, making it easier for employees to become eligible to participate.

Caution:

- Ensure owners are not excluded: Business owners should ensure that they are not excluded from the plan when selecting the eligibility requirements. For example, an 18-year-old business owner would be excluded if employees are required to be at least age 21 to participate in the plan.

- Ownership In Other Businesses Could Affect Eligibility: When determining eligibility to adopt an SBOK plan, ownership in any other business must be taken into consideration. This is because controlled groups of corporations, partnerships, or sole proprietorships under common control and affiliated service groups (ASGs) are treated as a single employer for employer plan purposes. And, if any of these other businesses employ common-law employees who would be eligible to participate in the 401(k) plan, the business would not be eligible to adopt an SBOK plan.

Relationships with certain leased employees might also affect eligibility.

Clients with ownership in multiple businesses and relationships with leased employees should consult with an attorney or other professional with expertise in the area of controlled group and leased employee relationships.

3: It Can Now Be Established Later Than Before

As of 2020, qualified plans can be established as late as the tax filing due date of the business plus extensions. For 2019 and earlier, the deadline was the end of the plan year.

Caution: If the business is incorporated, elective deferral contributions are withheld from wages/salary paid during the year. Therefore, if the intent is to make salary deferral contributions, the plan should be established soon enough to permit these contributions for the year. In addition, a salary deferral election should be made by the end of the year for unincorporated businesses.

4: It’s Inexpensive to Set up and Operate

According to a PEW research report, 37% of employers cite “too expensive” as the reason for not adopting a retirement plan, and 22% cite “lack of administrative resources”. This is not the case for an SBOK. Business owners have the option of using off-the-shelf prototype plan documents – including any IRS-required amendments – at no cost to the business owner or employee. Some providers charge an annual maintenance fee- typically under $100 for each account under the plan. Employers may choose other options, such as an individually designated plan. These are usually expensive and are not practical unless they provide a desired feature that is not available under a prototype plan.

Recordkeeping services are usually available for under $500 per year for those who want to farm out such services. This includes tracking contributions, distributions, and loans.

5: Contributions Come with Flexibility

There are two types of contributions that are usually offered under an SBOK: Elective deferral contributions and profit-sharing contributions.

For 2021, elective deferral contributions are limited to the lesser of 100% of compensation or $19,500. The limit increases to $20,500 for 2022. For those who are at least age 50 by the end of the year, an additional catch-up contribution of $6,500 is permitted.

Profit-sharing contributions are subject to a maximum deductible limit of 25% of compensation.

For 2021, the aggregate contributions cannot exceed the lesser of 100% of compensation or $58,000. For 2022 it is $61,000. Those who are at least age 50 by the end of the year may contribute an additional $6,500 in catch-up contributions.

Participants may choose from year to year whether to make salary deferral contributions and employer profit-sharing plans are discretionary. This gives the business owner/participant flexibility with determining whether to make any or both of these contributions each year.

6: Roth Is an Option

If permitted under the plan document, the trustee can choose to add Roth 401(k) account as a feature. Participants would then be able to contribute all or a portion of their elective deferral contributions to a Roth 401(k) account. In addition, participants would be eligible to convert amounts from their traditional 401(k) accounts to their Roth 401(k) accounts.

7: Contributions Are Tax Beneficial

Profit-sharing contributions are deductible subject to a limit of 25% of compensation. For 2021, compensation is capped at $290,000 for plan purposes. This compensation cap is increased to $305,000 for 2022. This deductibility helps to offset the cost of making these contributions. Employer contributions grow tax-deferred and are not taxed unless distributed to the participant.

Elective deferral contributions reduce participants’ taxable income, and like employer contributions, these also grow tax-deferred and are not taxed until distributed to the participant. But see Exceptions for Roth 401(k)s below.

Exceptions for Roth 401(k)s

Roth 401(k) elective deferral contributions are made with amounts that are included in the participant’s taxable income. In-plan conversions would result in any pre-tax amounts being taxable the year the conversion occurs.

Earnings in a Roth 401(k) grow tax-deferred and are tax-free when the participant is eligible for a qualified distribution.

Pro-Tip: A Roth suitability assessment should be done before recommending the Roth option to a client.

8: There is no Form 5500 Return up to $250,000

Form 5500 returns are not required for SBOKs as long as the balance does not exceed $250,000. Remind clients to be careful when calculating this amount as the account balance of all plan participants is included. This means that a plan that covers more than one business owner could get to this amount pretty quickly. So could a plan that accepts rollovers.

A Form 5500 must also be filed for the year the plan is terminated, regardless of the plan balance.

9: Loans Can Be Offered

The plan may be designed to allow loans to participants. Generally, loans are limited to the lesser of 50% of the participant’s vested account balance or $50,000. This can be a welcome feature for business owners who need cash and are unable to get traditional loans.

Caution must be exercised with loans to ensure that the limit is not exceeded, required repayments are made on time, and all other regulatory requirements are met. Breaking the loan rules could result in the loan being treated as a deemed distribution.

10: It’s An Asset Consolidation and Asset Gathering Tool

A participant may roll over amounts from eligible retirement plans to the SBOK. Eligible retirement plans include 403(b)s, governmental 457(b), and other qualified plans from which the participant is eligible to make withdrawals. Rollovers may also be made from IRAs (other than Roth IRAs).

Only eligible amounts are permitted to be rolled over. Amounts that are not eligible for rollover include required minimum distributions (RMDs) and after-tax amounts held in IRAs.

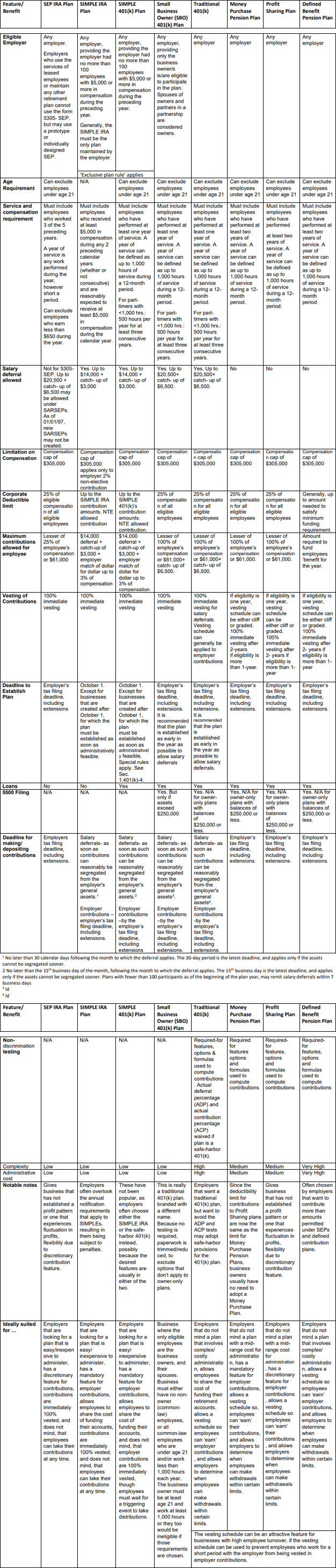

Perform A Suitability Assessment before Making the Choice

As attractive as these features are, that does not automatically translate to the SBOK being the ideal plan for a client. The determination of which plan is ideal should be done only after performing a suitability assessment. Consider, for instance, that an SBOK might not be ideal for a 40-year-old business owner whose only goal is to contribute $58,000 if she can get to that amount with a SEP IRA. My Employer Plan Comparison Table below shows some of the key features and benefits that should be considered when recommending a retirement plan for a small business.

Start Planning Now

Unlike clients who work for businesses that provide retirement benefits packages, your small business clients are on their own when it comes to saving for their retirement. Therefore, it is imperative that as you meet with your small business clients over the coming months- maximizing retirement savings must be one of the topics on the meeting agenda. Whichever employer plan you recommend, remind clients that they can amend the plan or change to a different type of plan as their business grows or determine that the plan chosen is no longer suitable.

With employer plans allowing for larger contributions than IRAs and rollovers, these plans do double duty by helping your clients save for retirement while serving as an asset gathering tool for their business.

Originally published in the August 2021 issue of Ed Slott’s IRA Advisor

Comparing Small Business Retirement Plans for 2022 Plan Year

For this table, employer means small business, including those that are part of a Controlled Group or Affiliated Service Group